Pamm

PAMM stands for Percentage Allocation Management Module, which has become one of the most popular Forex Brokers Tool.

With the advent of Forex Trading started a cult of Forex Traders where top Forex Master Traders became messiah and the retails and small time traders turned into their followers. And this not for any random reason but for a solid trading and earning performance. These small retail Forex Traders started asking these Master Traders if they could simply copy the trades to make profit. And we developed this solution called PAMM which lets Slave Traders or Follower Traders to copy the trades of Master Traders. The catch here was that while Master Traders could trade with large sum, small followers would have smaller sums. To curb this issue, PAMM comes handy as it lets forex traders to allocate small sums in a proportion to copy the trades of Master Traders.

How does PAMM work?

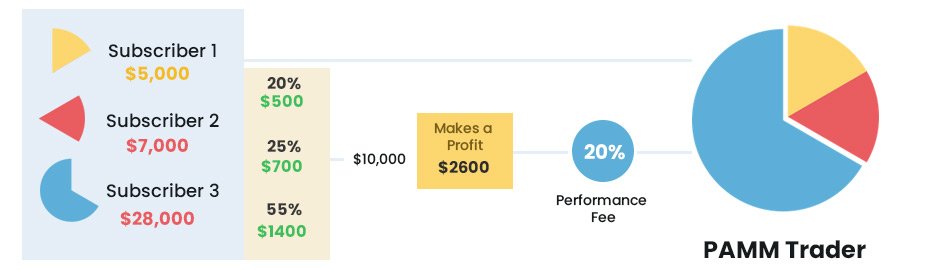

Well, it allows Master Forex Trader to handle several accounts of other Forex Traders’ managed accounts. Every single Managed Forex Traders Account can have pre-defined proportion on which it wants to allocate funds for copying trade. So when a Master Trader takes a trade, he actually places order on behalf of follower traders in proportions. It can also be explained as, the trade size is sum of all follower account’s proportionate contribution.

What’s in PAMM for Master Forex Traders?

PAMM opens up additional revenue streams for Master Traders. They can monetize their capabilities and skills to take profitable trades. The forex traders who intend to copy trades of Master Traders are happy to pay for this services. PAMM facilitates Master Traders to earn in following ways:

- Joining Fee: They can charge a onetime joining fee depending on the demand and past performance. High performing and profitable traders can easily ask for one joining fee to connect and manage their accounts using PAMM. This is completely optional and there are many even don’t charge any upfront joining fee.

- Recurring Fee: To keep on availing the services, Master Traders can charge recurring fee. They can charge the traders to manage their accounts on weekly, monthly, and quarterly, six monthly or yearly fee.

- Profit Sharing: Many top performing master traders charge fixed percentage of profits if their trades make profit. Small traders don’t hesitate paying it as they know that ultimately they are making money that too because of master trader’s skills only.

So what are you waiting for? Contact us and we will give you a LIVE DEMO to show you what we have got.